Not investment advice. Do your own research.

Markets & price action

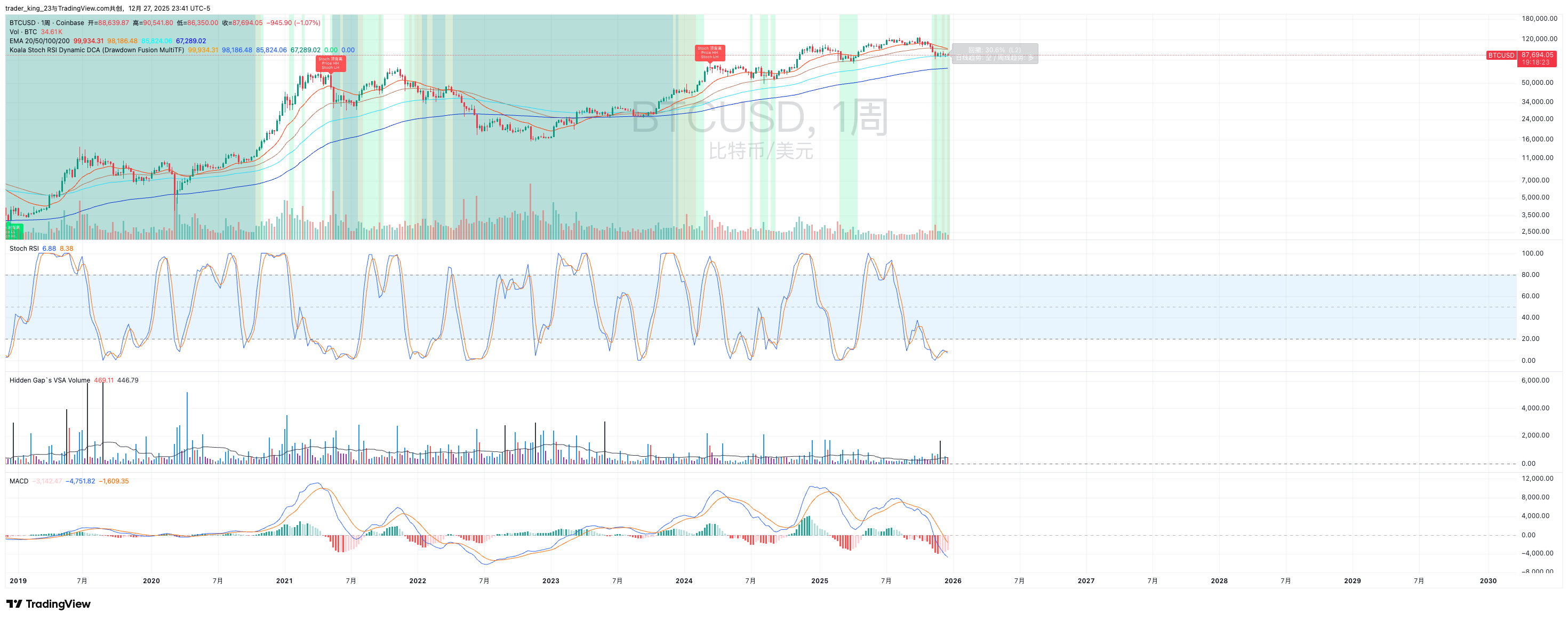

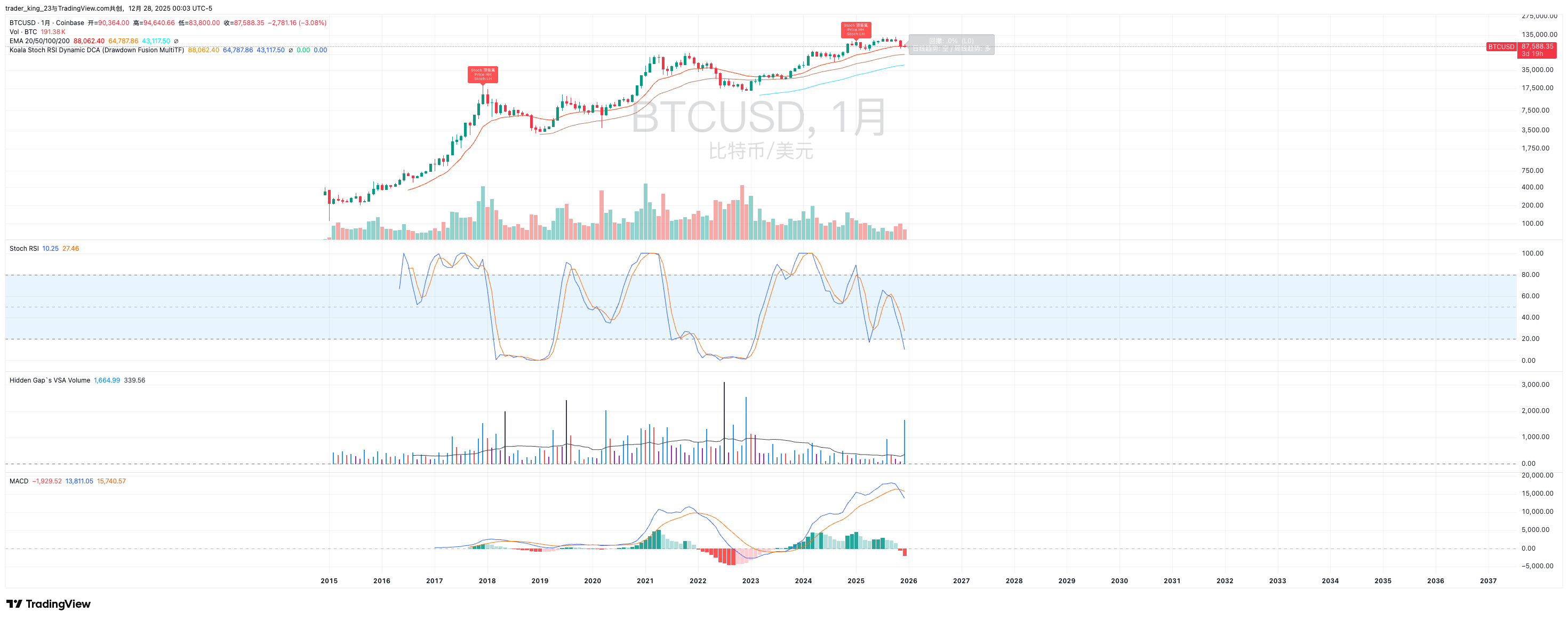

- BTC probably makes a new ATH in 2026, but the path is grindy: I expect a bounce after several weeks based on the weekly chart, and that bounce likely tags a new ATH. After that, over a longer horizon (after several months), I expect BTC to trade materially lower. Fewer straight-line manias, more range trading and quiet institutional absorption.

- SOL likely rhymes with BTC, but with bigger downside: I expect Solana to bounce on the weekly timeframe and then draw down on the monthly timeframe. Compared to BTC, SOL likely sees a larger drawdown.

- I’m more bullish on ETH than BTC and SOL in the next several months: on the charts, ETH looks bullish on both the weekly and monthly timeframes. That said, ETH tends to carry higher volatility and more leverage, so the path higher will likely be even more grindy than BTC. It could dip lower first, then push higher.

- No more broad “alts go up together” season: I don’t expect a classic, across-the-board alt season where everything pumps. Altcoin performance should become more selective and more tied to real fundamentals and execution. The “farm-and-dump” coins will likely either never recover or keep bleeding after listings. There are simply too many alts and limited liquidity. If anything works, I’d focus on projects that can bridge Web2 and Web3 and connect real-world rails to onchain rails—RWA, tokenization, stablecoins, and related infrastructure. Because such projects are able to drive money from traditional finance. Privacy is also a theme worth watching.

- BTC volatility keeps compressing and looks more macro-like: a broader holder base and more passive and regulated flows should mean fewer extreme candles. Trading crypto becomes extremely hard but investing will be more valuable.

- The “4-year cycle” keeps weakening: the halving still matters, but its marginal impact fades; rates and liquidity matter more.

Institutions, Regulation, and Distribution

- The U.S. enters an ETF expansion era: beyond BTC and ETH, more index, thematic, and yield-wrapped products become easy to buy.

- ETF palooza (100+ U.S. crypto ETFs): we could see 100+ U.S. crypto ETFs, including 50+ altcoin and multi-asset products. A plausible path is $50B+ net inflows that can absorb a large share (and at times 100%+) of net new supply for BTC/ETH in strong flow windows (and potentially large-cap alts like SOL), similar to how gold ETFs accelerated adoption.

- Institutions normalize allocation: it wouldn’t surprise me if a meaningful share of Ivy League endowments have some exposure by the end of 2026, and model portfolios start recommending 5–10% allocations for clients with high risk tolerance.

- Consumer platforms become the distribution wedge: platforms like Coinbase and Robinhood make ETF access and portfolio rebalancing frictionless, pulling more TradFi capital into crypto via the path of least resistance.

- Market structure clarity becomes a top catalyst: once rules are clearer, banks, brokers and wealth platforms can distribute at scale.

- Flows beat vibes: net demand through regulated rails can outpace new supply, and pricing gets driven by flows more than retail mood.

Infrastructure and Corporatization

- M&A stays hot and full-stack platforms consolidate share: trading, custody, lending, settlement, compliance, and data get integrated into a smaller set of winners.

- Crypto equities improve on a relative basis: clearer rules, broader product lines and consolidation will improve business quality.

Tokenization & RWAs

- RWAs go 10x and shift from tokenized wrappers to onchain origination: RWAs could grow toward $200B–$500B as more issuance happens natively onchain (debt, equities, real estate, and exotics). The unlock is lower issuance and servicing cost, plus more composable distribution.

- RWA perps and synthetic exposure grow faster than direct ownership: perps on tokenized underlyings can deliver leverage and price exposure without the full custody and ownership workflow, but the regulatory surface area will still be real.

- Specialized venues for illiquid assets appear and M&A follows policy clarity: expect niche exchanges and prop-AMMs optimized for pre-IPO shares and other illiquid RWAs. If regulation tightens into clearer lanes (e.g., a CLARITY-style framework), it likely catalyzes a new wave of tokenized assets and a spike in acquisitions across infra, broker dealers, and distribution.

Stablecoins & Payments

- Stablecoins become a default rail for cross-border B2B settlement and also get a political “blame moment”: an EM FX/capital flow episode puts them in headlines and accelerates the push toward compliance.

- Stablecoin market cap doubles and stablecoin throughput starts to rhyme with major payment networks: I wouldn’t be surprised to see stablecoin market cap reach $500B–$750B, with annualized onchain transfer volume pushing $10T–$46T. Stablecoins become mainstream for payments, FX, and cross-border flows, not as a crypto product, but as the settlement layer underneath.

- Invisible payments wins distribution: the best UX hides chain complexity via smart ramps, compliance, and embedded wallets. This is the path where stablecoins overtake ACH-like use cases and start encroaching on Visa or PayPal-style consumer payment and fintech volumes.

- Agentic economies go from meme to real: AI agents increasingly pay each other and pay for services autonomously using standardized payment flows (e.g., x402-style patterns). That expands programmable settlement beyond humans and into machine-to-machine commerce.

DeFi

- Productization beats protocol worship: vaults, strategies, structured products (“ETFs 2.0”) grow AUM.

- DeFi gets big enough to matter: TVL can plausibly push toward $1T, with DEXs sustaining 25%+ of spot volume and crypto-backed lending surpassing $90B. The winners are “fat apps” that capture more of the value (fees, spreads, financing) rather than thin protocols.

- Capital-efficient primitives expand the TAM: composable perps that blend lending and trading, better collateral reuse, and improved liquidation and risk engines move the UX closer to prime brokerage.

- Onchain credit moves beyond overcollateralization: unsecured or undercollateralized credit starts to scale slowly via reputation, cashflow underwriting, and more transparent risk controls, opening whole new categories of borrowers.

- Privacy and UX become investable categories again: privacy tokens can re-rate toward $100B market cap, and chain abstraction (accounts, gas, bridging) keeps improving so users stop caring which chain they’re on.

Prediction markets

- Prediction markets explode and converge with trading and media: weekly volumes can plausibly push above $1.5B (10x from here) as markets become a default way to trade narratives and hedge real-world outcomes. Expect “smart markets” tightly integrated into trading terminals, news, and portfolios. Consumer leaders (e.g., Polymarket-style products) matter, but a meaningful chunk of upside likely gets captured by TradFi distribution and VC-backed platforms.

- Futarchy stops being a thought experiment: at least one serious DAO uses signals from prediction markets to steer governance over $500M+ in assets, moving from vibes-based voting to decision making aligned with incentive.

AI (and agents)

- AI-crypto convergence becomes investable: AI-crypto sector can grow toward $10B, with agents managing 5%+ of DeFi strategies (routing, rebalancing, yield, and trade execution). Vibe-coded contracts and agent-driven automation increase velocity, but also create new failure modes.

- DePIN expands beyond GPUs into data for robotics and autonomy: networks that incentivize high-quality sensor or robotics data start to matter, because AI needs real-world feedback loops, not just text.

- Quantum-resistant tech gets a panic-driven bid: quantum won’t necessarily break crypto in 2026, but headlines and fear can still catalyze adoption of quantum-resistant primitives and migrations.

- Web3 becomes AI’s coordination layer: crypto rails (identity, incentives, payments, verifiable state) increasingly look like the natural substrate for coordinating agents across apps and organizations.

- A crypto superapp emerges (wallet + trading + stablecoin payments + earn, in one UX): the winning app won’t feel like DeFi, it’ll feel like a modern fintech app where onchain is mostly invisible. The moat is combining distribution, compliance and great mobile UX, not governance tokens. I expect one or two players to bundle trading, payments, earn, and a lightweight app store of onchain actions. More apps will also ship app-specific wallets and embedded points rails, making the user relationship the product and the chain the backend. The constraint won’t be tech, it’ll be regulation, fraud and who can own the user relationship.

My framework

In 2026, I think the crypto story shifts further from narratives to plumbing: distribution, rails, and execution.

- Distribution becomes the product: ETFs and other regulated wrappers turn crypto from “an app you download” into “a line item in a portfolio”. This is what makes flows sticky.

- The rails get real: stablecoins + tokenization + onchain settlement start to look like financial infrastructure, not experiments. Payments and origination move onchain because it’s cheaper and faster.

- Execution beats ideology: the winners look like full-stack businesses (compliance, custody, liquidity, UX), not just protocols.

- Apps + agents create native demand: superapps, embedded wallets, and AI agents add new transaction volume (both human and machine-to-machine).

What would change my mind

- ETF hype without ETF flows: if approvals happen but inflows disappoint (or liquidity fragments across too many products), the “flows beat vibes” thesis weakens.

- Policy stalls or reverses: if market structure legislation fails or enforcement ramps, the regulated distribution arc slows down.

- A liquidity shock: if macro tightens or credit breaks, risk assets including crypto can stay heavy even with great fundamentals.

- Stablecoin or tokenization regulatory shock: one high-profile incident (sanctions, banking stress, EM FX crisis scapegoating) or a hard turn on what counts as a security can change timelines fast.

- Security or regime risks: major protocol, custody, or governance failures could reset trust for a cycle.

Overall my bet is that 2026 is less about one narrative and more about compounding adoption via distribution (ETFs), rails (stablecoins + tokenization), and execution (apps + agents).